Every individual plan to reduce their tax liability and to support tax planning. The growth of the financial/insurance sectors government has allowed various deductions from taxable income. Section 80C to 80U of the Income Tax Act, 1961 in India provides various deductions to individuals and Hindu Undivided Families (HUFs) to reduce their taxable income and avail tax benefits. These deductions are available for specific investments, expenses, and contributions made by taxpayers.

In this article we briefly cover all the relevant sections in which Individuals and HUFs can avail deductions from their taxable income and reduce their overall liabilities while investing/saving for their future and uncertainties:

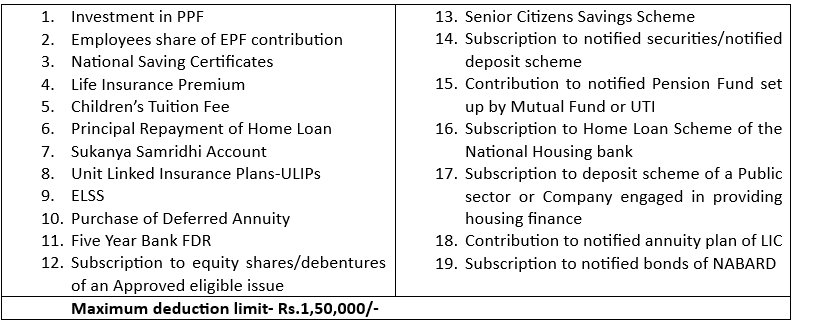

Section 80C – Investments

Section 80C allows deduction on below investments:

Section-80CCD(1B) – National Pension Scheme Contribution

Under Section 80CCD(1B), an individual taxpayer can claim a deduction for contributions made towards the NPS Tier-I account. The deduction under Section 80CCD(1B) is over and above the deductions available under Section 80C and Section 80CCD (1). This means that an individual taxpayer can claim deductions up to Rs. 1.5 lakh under Section 80C and an additional Rs. 50,000 under Section 80CCD(1B) for NPS contributions.

| Deduction available on | Additional contribution to NPS Tier-1 during a financial year |

| Maximum Deduction Limit | Rs.50,000/- |

Section-80TTA (1) – Deduction for Interest on Saving Account

Under Section 80TTA (1), an individual taxpayer or HUF can claim a deduction on the interest earned from savings accounts held with banks, co-operative societies, or post offices. If the taxpayer has earned interest on other sources, such as fixed deposits, that interest will not be eligible for this deduction.

| Deduction available on | Interest earned on saving account. |

| Maximum Deduction Limit | Rs.10,000/- (Collectively for all Saving Account) |

Section-80TTB – Deduction for Interest Earned by Senior Citizens

Under Section 80TTB, senior citizens can claim a deduction on interest income earned from specified sources. The specified sources include interest earned from savings accounts, fixed deposits, recurring deposits, and deposits in post offices.

This deduction is only available to senior citizens i.e., individuals above the age of 60.

| Deduction available on | Interest earned on saving account, FDRs, Post Office Deposit |

| Maximum Deduction Limit | Rs.50,000/- (Collectively for all Interest earned) |

Section-80E– Deduction for Interest paid on Education Loan

The deduction under Section 80E is available for the interest paid on loans taken for higher education purposes only. These loans must be taken from any financial institution or approved charitable institution in India or abroad.

This deduction was introduced to promote higher education in India..

| Deduction available on | Interest paid on Education Loan for Higher Education |

| Condition | Deduction is available only if loan is taken for taxpayer, their spouse, or their children or for whom the taxpayer is a legal guardian. |

| Maximum Deduction Limit | No Limit |

| Period of Deduction | 8 Years starting from year taxpayer starts repaying loan. |

Section -80GG – House Rent Paid for No HRA Case

Section 80GG of the Income Tax Act, 1961, provides a deduction for individuals who do not receive House Rent Allowance (HRA) but incur rental expenses. This deduction is available to both salaried and self-employed individuals.

| Condition to Avail deduction | a. The taxpayer should be an individual (salaried or self-employed). b. The taxpayer or their spouse or minor child should not own any residential accommodation at the place of employment or business or any other place where the taxpayer ordinarily resides. c. The taxpayer should not receive any House Rent Allowance (HRA) from their employer. |

| Maximum Deduction Limit | Least of the following: a. Rs. 5,000 per month b. 25% of the total income of the taxpayer for the year c. Excess of actual rent paid over 10% of the total income. |

| Filing of Form-10BA | If the annual rent paid exceeds Rs. 1,00,000 then taxpayer may need to furnish a declaration in Form 10BA. |

Section-80D– Medical Insurance Premium

Section 80D of Income Tax Act,1961 provides for deduction in respect of premium paid for health insurance policies by Individuals and HUFs. It encourages taxpayers to secure health insurance for themselves and their families and helps in reducing their taxable income.

| Deductions | Deduction under section 80D is available for: a. Health insurance premium on the life of taxpayer, spouse, children and parents b. Expenditure on preventive health care upto Rs.5000/- c. Medical Expenditure on health of senior citizen (in case of no health policy in name of senior citizen) |

| Maximum Deduction Limit | a. Combined for health insurance premium and preventive check-up up to Rs.25,000/- (In case of non-senior citizen) b. In case of Senior Citizen including senior citizen parents up to Rs.50,000/- Total overall limit will be Rs.75,000/- |

| Condition | Premium should be paid in mode other than Cash. |

Section-80EE – Interest on Home Loan

Section 80EE of Income Tax Act,1961 was introduced to promote home ownership amongst individual specially those who are buying for the first time. The section allowed individuals to claim a deduction over and above the existing deductions available under Sections 24(b) and 80C for the repayment of the principal amount.

| Conditions | a. Only first-time home buyers can claim. b. home loan up to Rs.35 lakh and Property Value Rs.50 lakh. |

| Maximum Deduction Limit | Flat deduction of Rs.50,000/- irrespective of actual interest paid during a financial year. |

| Duration of Deduction | 7 Assessment year starting from year of loan |

Section-80RRB – Royalty of a Patent

| Conditions | a. Available only to resident individual b. having income from royalty from patent. |

| Maximum Deduction Limit | Lower of the: Rs.300000/- or Royalty income |

| Duration of Deduction | maximum of 5 consecutive assessment years beginning from the year in which the patent was registered. |

| Additional Requirement | a. Certificate in Form-10CCE to be filed b. In case royalty received in foreign exchange then a certificate in form 10H to be furnished along with ITR |

Section-80DD– Expenditure on medical treatment of Disabled Dependent

Section 80DD of Income Tax Act,1961 provides for deduction to resident individuals and Hindu Undivided Families (HUFs) who incur expenses on the medical treatment and care of dependents with disabilities. This section was introduced with the aim to provide financial support to individuals and HUFs who have disabled dependents and incurring cost on their care.

| Eligible Deduction | a resident individual or HUF can claim a deduction for expenses incurred on medical treatment, training, and rehabilitation of a dependent with a disability. |

| Maximum Deduction Limit | a. If the disability is 40% or more but less than 80%, the deduction allowed is Rs. 75,000. b. If the disability is 80% or more, the deduction allowed is Rs. 1,25,000. |

| What is Disability | The disabilities covered include blindness, low vision, leprosy-cured, hearing impairment, locomotor disability, mental retardation, and mental illness. |

| Other Conditions | a. Certificate in Form-10IA required from medical authority b. No deduction claimed under section 80U for same dependent c. To claim the deduction, the individual must have incurred expenses on the medical treatment and care of a dependent with a disability. |

Section-80DDB– Expenditure on medical treatment of disabled dependent

Section 80DDB of Income Tax Act,1961 provides for deduction to resident individuals and Hindu Undivided Families (HUFs) who incur expenses on the medical treatment of specified diseases for themselves or their dependents.

| Eligible Deduction | A resident individual or HUF can claim a deduction for expenses incurred on medical treatment, of specified diseases for themselves, their spouse, children, parents, or siblings (in case of HUF). |

| Maximum Deduction Limit | a. For individuals below 60 years of age, the maximum deduction is Rs. 40,000. b. For individuals who are 60 years or above, but below 80 years, the maximum deduction is Rs. 1,00,000 |

| What is Specified Disease | the diseases covered include various neurological diseases, malignant cancers, chronic renal failure, and certain other life-threatening ailments. |

| Other Conditions | a. Prescription for medical treatment required b. Deduction under this section to be reduced if amount recovered under any insurance, c. To claim the deduction, the individual must have incurred expenses on the medical treatment. |

Section-80GGB – Deduction on contribution by Companies to political parties

Section 80GGB of Income Tax Act,1961 provides for deduction to companies to claim a deduction for the amount donated to political parties as part of their corporate social responsibility or other charitable activities.

| Eligible Assessee | Indian Companies (Both domestic and foreign companies registered in India) |

| Maximum Deduction Limit | any amount contributed to political parties or electoral trusts registered under the Representation of the People Act, 1951. |

| Mode of Payment | Other than cash |

Section-80GGC – Deduction on contribution by Individuals to political parties

Section 80GGC of Income Tax Act,1961 provides for deduction to companies to claim a deduction for the amount donated to political parties as part of their corporate social responsibility or other charitable activities.

| Eligible Assessee | any person, except local authority and every artificial juridical person wholly or partly funded by the Government and company. |

| Maximum Deduction Limit | any amount contributed to political parties or electoral trusts registered under the Representation of the People Act, 1951. |

| Mode of Payment | Other than cash |

Section-80U– Deduction in case of a person with disability

Individuals who have certified disabilities are eligible to receive an income deduction under Section 80U of the Income Tax Act.

| Eligible Assessee | A resident individual certified to be a person with disability. |

| Deduction Limit | a. If person is suffering with disability, then deduction is Rs.75,000/- b. If person is suffering with severe disability, then deduction is Rs.1,25,000/- |

| What is Disability | “disability” shall have the meaning assigned to it in clause (i) of section 2 of the Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995 (1 of 1996), and includes “autism”, “cerebral palsy” and “multiple disabilities” referred to in clauses (a), (c) and (h) of section 2 of the National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities Act, 1999 (44 of 1999); |

| What is Severe Disability | “person with severe disability” means— (i) a person with eighty per cent or more of one or more disabilities, as referred to in sub-section (4) of section 56 of the Persons with Disabilities (Equal Opportunities, Protection of Rights and Full Participation) Act, 1995 (1 of 1996); or (ii) a person with severe disability referred to in clause (o) of section 2 of the National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation and Multiple Disabilities Act, 1999 (44 of 1999). |

| Other Conditions | Every individual claiming a deduction under this section shall furnish a copy of the certificate issued by the medical authority in the Form-10IA along with the return of income under section 139, |

Conclusion:

It is recommended that readers seek professional assistance from experts such as Chartered Accountants, Company Secretaries, and Lawyers. These professionals can provide guidance on the technical aspects mentioned above and help prevent any legal issues or notices from the relevant department.

For any guidance kindly contact our expert.