Selecting a name for your LLP is an important decision as it represents your brand and identity. Here are some steps you can follow to choose a name for your LLP:

1.Reflect your brand: The name should align with your brand and convey the right message to your customers.

2. Make it unique: Conduct a thorough search to ensure that the name you choose is not already in use by another company in your industry. This helps you avoid legal conflicts and confusion among customers.

3. Be memorable and easy to pronounce: Select a name that is catchy, easy to remember, and easy to pronounce.

4. Consider domain availability: In today's digital age, it is important to have an online presence. Check the availability of domain names that match or closely resemble your LLP name.

5. Check trademark registrations: Conduct a search to see if the name you want to use is already trademarked. This will help you avoid potential legal issues in the future.

6. Consider future growth: Ensure that the chosen name is broad enough to accommodate future expansion into different products, services, or geographic regions, if applicable.

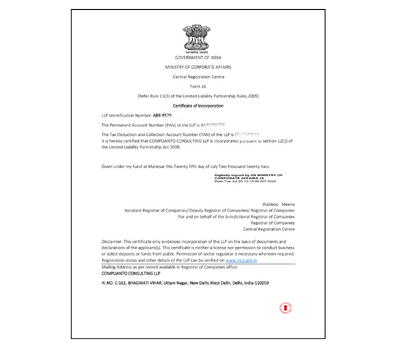

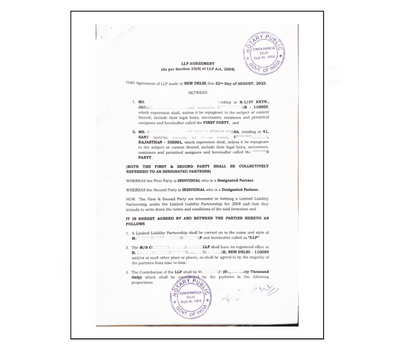

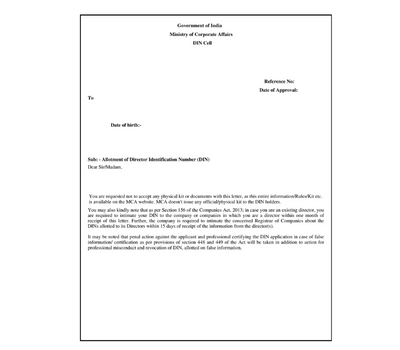

7. Register the name: Once you have finalized a name, you can get approval of the name with Registrar of Companies.

Remember, choosing a name is a creative process, and it's important to take your time and consider multiple options before making a final decision.