What all you get

Company Name Approval

2 DIN

2 Digital Signature

e-MOA & e-AOA

Certificate of Incorporation

PF & ESI

PAN & TAN

CA ASSISTANCE

Professional Tax

*Contact our team for discounts & offers

Private Limited Company Registration

Our Incorporation Support Covers

We will provide assistance in obtaining all the below documents as part of private limited company registration .

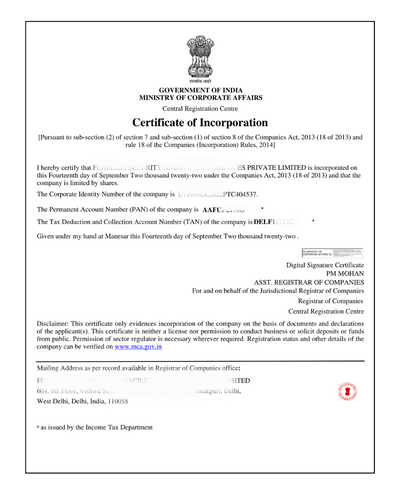

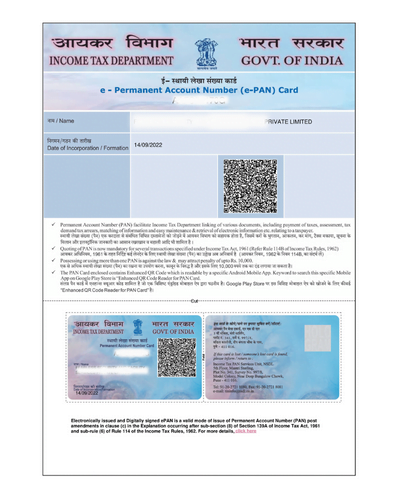

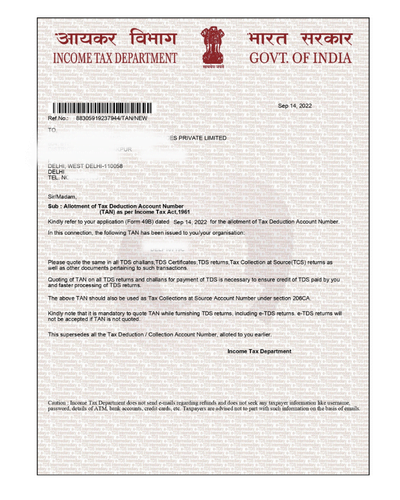

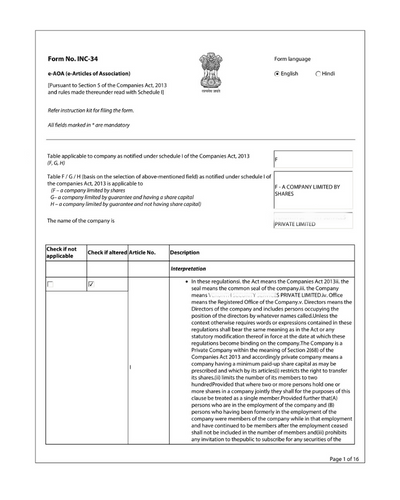

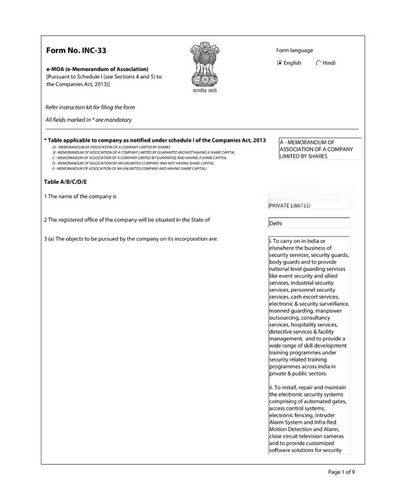

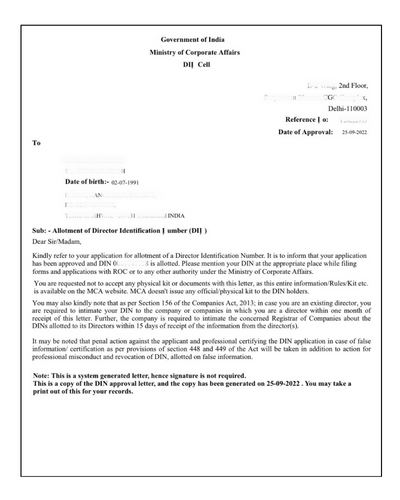

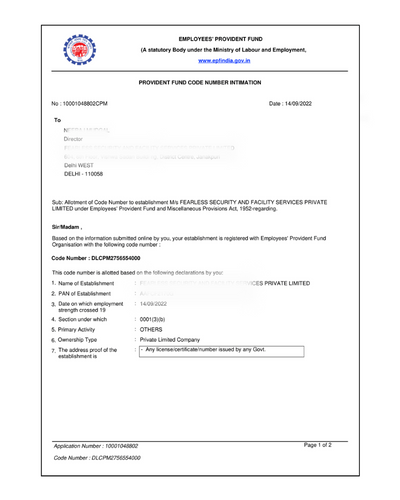

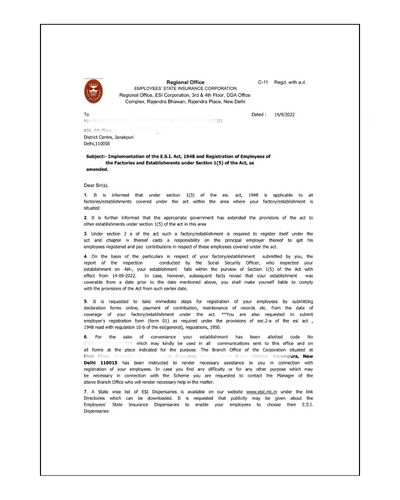

Below are all Sample Certificates for Illustrative Purposes Only. Final documents are issued by the respective government authorities.

- Incorporation Certificate

- Permanent Account Number (PAN)

- Tax Deduction Account Number (TAN)

- Articles of Association (AoA)

- Memorandum of Association (MoA)

- Director Identification Number (DIN)

- Provident Fund Registration (PF)

- Employee State Insurance Registration (ESI)

- Digital Signature Certificate (DSC)

- CA/CS Assistance

OUR PROCESS FOR

Private Limited Company Registration

Step-1

FILL FORM

Step-2

DISCUSS WITH OUR EXPERTS

Step-3

SHARE DOCUMENTS

Step-4

DELIVERY OF CERTIFICATE

Step-1

FILL FORM

Step-2

DISCUSS WITH OUR EXPERTS

Step-3

SHARE DOCUMENTS

Step-4

GET CERTIFICATE

What is

Private Limited Company

A private limited company refers to a privately held, legally-recognized business entity that is owned by private stakeholders. The legal terms of this type of company are defined as per Section 2(68) of the Companies Act, 2013.”. The members' liability in a private limited company is limited to the amount of shares held by them. A private Limited company enjoys a separate legal entity independent from its owners, directors and shareholders.

Investors trust a private limited company and it limits the founder's liability to the extent of their shareholding, making it advantageous for startups. A private company requires a minimum of two directors.

ALL YOU NEED TO KNOW ABOUT

COMPANY REGISTRATION

At Complianto Consulting, our experts are committed to guide you on the right form of Company Registration

REGISTRATION PROCESS FOR

Private Limited Company

The registration process of a company is done under the Ministry of Corporate Affairs (MCA), which is governed by the Companies Act 2013. Given below are the steps involved:

Get help from our Experts for your Company Registration!

- Step 1 - Apply for DSC

- Step 2 - Unique Name Reservation

- Step 3 - Apply for DIN

- Step 4 - Filing of SPICe Part B Form (INC-32)

- Step 5 - Filing of MoA and AoA

- Step 6 - Filing of Agile Pro

- Step 7 - Filing of INC-9

- Step 8 - Issuance of Certificate of Incorporation

Apply for DSC

Obtaining a Digital Signature is the first step of an online company registration process. A DSC or a Digital Signature Certificate works as a proof of identity for the director. DSCs are mandatory for all proposed directors.

Unique Name Reservation (Filing of SPICe Part A)

The second and the most important step for incorporating a company is to reserve a Unique Name for your business. While choosing a name one has to consider below points

1. The name of your company cannot just be a random word. It must represent your brand and business activity to be recognizable by your customers appropriately

2. Additionally the name must not be similar or identical to the name of an existing Company, LLP, or a registered trademark

Apply for DIN

DIN, or Director Identification Number, is a distinctive 8-digit identifier assigned by the Ministry of Corporate Affairs (MCA) to individuals serving as directors in a company. This unique identification number possesses lifetime validity.

Filing of SPICe Part B Form (INC-32)

Once the Name is reserved, the next step is to File INC-32 form on MCA Portal.Below are the details required for the form

- Details of registered office of the Company.

- Details of authorized and paid-up share capital.

- Details of its directors,members and subscribers.

- Details of AO code for PAN TAN and business code.

Filing of MoA and AoA

MOA serves as the foundational document outlining a company's constitution, often referred to as the charter. MoA contains the location of the registered office of the company, company's scope of activities, authorised capital of the company and subscribers details.

AoA is the auto drafted form in line with Companies Act 2013, however any authority and/or restrictions in it can be done within the scope of the companies act.

Filing of Agile Pro

Post approval of the mentioned steps from the Ministry of Corporate Affairs. the department will issue all the documents like PAN/TAN along with the" Certificate of Incorporation"

Filing of INC-9

Obtaining a Digital Signature is the first step of an online company registration process. A DSC or a Digital Signature Certificate works as a proof of identity for the director. DSCs are mandatory for all proposed directors.

Issuance of Certificate of Incorporation

Post approval of the mentioned steps from the Ministry of Corporate Affairs. the department will issue all the documents like PAN/TAN along with the" Certificate of Incorporation"

Benefits of

Private Limited Company Registration

Below are the Benefits that you get in Private Limited Company Registration Over Limited Liability Partnership or One Person Company or Partnership firm

Your Business Become Legitimate

Since Pvt. Ltd. Company is listed with MCA, it enjoys a legal status which has its own existence separate from the people who runs it.

Limited Liability Of The Owners

Since the future is always uncertain and in case a business fails then in private limited its shareholders liability is to the extent of its investment in company but in case of partnership/ Sole Proprietorship even personal assets will be at risk.

Tax Benefits- Lower Tax Rates

To promote company culture govt. has provided benefits of reduced rates of 22% and 25% for companies. Though for other form of business it will always be 30%.

Better Image And Credibility

Since there is transparency due to govt. regulations, private limited company is mostly preferred by the corporate clients, investors, lenders and vendors, as compare to Proprietorship or partnership firm.

Ease Of Fund Raising

Due to its legal existence a private limited company enjoys more access to fund from banks, angel investors and VC firms, which is difficult in other forms of business.

Enhances The Ability To Become Large And Expand

Due to ease of raising funds along with trust with the business partners it becomes easy for Pvt. Ltd. Company to expand their business and leave a strong footprint.

Benefits of

Private Limited Company Registration

Below are the Benefits that you get in Private Limited Company Registration Over Limited Liability Partnership or One Person Company or Partnership firm

Your Business Become Legitimate

Since Pvt. Ltd. Company is listed with MCA, it enjoys a legal status which has its own existence separate from the people who runs it.

Limited Liability Of The Owners

Since the future is always uncertain and in case a business fails then in private limited its shareholders liability is to the extent of its investment in company but in case of partnership/ Sole Proprietorship even personal assets will be at risk.

Tax Benefits- Lower Tax Rates

To promote company culture govt. has provided benefits of reduced rates of 22% and 25% for companies. Though for other form of business it will always be 30%.

Better Image And Credibility

Since there is transparency due to govt. regulations, private limited company is mostly preferred by the corporate clients, investors, lenders and vendors, as compare to Proprietorship or partnership firm.

Ease Of Fund Raising

Due to its legal existence a private limited company enjoys more access to fund from banks, angel investors and VC firms, which is difficult in other forms of business.

Enhances The Ability To Become Large And Expand

Due to ease of raising funds along with trust with the business partners it becomes easy for Pvt. Ltd. Company to expand their business and leave a strong footprint.

List of Documents Required for

Private Limited Company Registration

Below are the documents required for the process of Private Limited Company Registration:

- Director’s Photo

- Director’s Voter ID, PAN and Aadhaar

- Latest Bank Statement with Address

- Rent Agreement or Ownership Proof

- Latest Electricity Bill

- NOC from Owners (If not rented)

- Digital Signature Certificate (DSC)

- Director Identification Number (DIN) if any proposed director already having

Important Points To Consider For

Private Limited Company Registration

Below are the important points to consider for the process of Private Limited Company Registration:

- Minimum 2 shareholders and 2 directors required (One director should be Indian national)

- Authorised capital and paid up capital can be as low as Rs.10000

- One witness for MOA and AOA subscribers

- All KYC documents should be self attested and Electricity bill/telephone bill and Bank statement should not be more than 30 days old.

- Rent agreement should be in the name of the proposed director only. (Rent agreement in the name of proposed company is not acceptable)

- Rent agreement should contain witnesses and KYC of the director to be part of agreement with notary attested.

Have A Question?

FREQUENTLY ASKED QUESTIONS (FAQs)

For private limited company registration process ,time can vary depending on the jurisdiction and the efficiency of the registration process. In general, the registration process involves several steps that may include name reservation, preparation of company documents, filing of the necessary forms, and obtaining the required approvals.

Selecting a name for your company is an important decision as it represents your brand and identity. Here are some steps you can follow to choose a name for your company:

- Reflect your brand: The name should align with your brand and convey the right message to your customers.

- Make it unique: Conduct a thorough search to ensure that the name you choose is not already in use by another company in your industry. This helps you avoid legal conflicts and confusion among customers.

- Be memorable and easy to pronounce: Select a name that is catchy, easy to remember, and easy to pronounce.

- Consider domain availability: In today’s digital age, it is important to have an online presence. Check the availability of domain names that match or closely resemble your company name.

- Conduct a search to check if someone has already trademarked the name you want to use. This will help you avoid potential legal issues in the future. This will help you avoid potential legal issues in the future.

- Consider future growth: Ensure that the chosen name is broad enough to accommodate future expansion into different products, services, or geographic regions, if applicable.

- Register the name: Once you have finalized a name, you can get approval of the name with Registrar of Companies.

Remember, choosing a name is a creative process, and it’s important to take your time and consider multiple options before making a final decision.

Yes, it is mandatory to have a office for registering a company in India. Though government gives 30 days time to file for registered office after registering a company.

A startup which has limited funds can also opt for co-working space or even Virtual Offices to register their company.

Note: It is mandatory for a company to keep their books of accounts at their registered office or any place as informed by them to the registrar of Companies.

To register a private limited company in India, a minimum of two directors are required.

In India, a private limited company has perpetual existence unless it is dissolved or wound up according to the provisions of the Companies Act, 2013.

Perpetual existence means that the company continues to exist even if its shareholders or directors change over time. The company is considered a separate legal entity from its owners, and its existence is not dependent on the life or actions of any individual associated with the company. The death, retirement, or resignation of a director or shareholder does not affect the continuity of the company.

When a private limited company is no longer in operation or is in losses, its shareholders may decide to close it. The process of closing a private limited company in India is relatively simple and can be completed in a few steps.

- A board meeting to be Convened in which a resolution should be passed with a declaration by the directors that they have made an enquiry in the affairs of the

There is no Minimum Capital required to start a company. Private Limited Company Registration can be done with capital as low as Rs.10. But in general most of the companies are registered with a capital of Rs.1 lakh.

Yes, Non-Resident Indians (NRIs) and foreign nationals can become directors in a private limited company in India. The Companies Act, 2013 allows for the appointment of NRIs and foreign nationals as directors, subject to certain requirements and conditions. Here are some key points to consider:

- Director Identification Number (DIN)

Every individual who wishes to become a director in a company in India, including NRIs and foreign nationals, must obtain a Director Identification Number (DIN) from the Ministry of Corporate Affairs (MCA).

- At least one Resident Director

As per the Companies Act, 2013, every private limited company in India must have at least one director who is a resident of India. A resident director is an individual who has stayed in India for a minimum period of 182 days in the previous calendar year.

- Documentation and Legal Compliance:

NRIs and foreign nationals must provide the necessary documentation, such as a valid passport, address proof, and other identity proofs, as required by the MCA. These documents may need to be notarized or apostilled, depending on the country of origin.

You manage business, we manage your compliances

Our team is constantly working towards the highest level of compliance solutions for you.

GET FREE CONSULTATION

(Mentorcorp Private Limited) is a privately owned consultancy firm. We (https://compliantoconsulting.com) are not a government website and are not associated with, authorized by, or representing any government body.

We do not issue, provide, or guarantee any government documents, registrations, licenses, or certificates. Our role is strictly limited to professional consultancy, advisory, and documentation support only.

All government applications, approvals, and official services are processed exclusively by the respective Government authorities. Any fees charged by Mentorcorp private limited are solely for consultancy services.

Copyright @ MENTORCORP PRIVATE LIMITED. All rights reserved